The Elecnor Group raises its dividend by 19.7% after earning EUR 102.8 million in 2022

The Group has shown an improvement in all its areas of activity and has achieved a turnover of EUR 3,613.7 million, 15.7% more than in 2021

The Elecnor Group achieved a net profit of EUR 102.8 million in 2022, representing a 19.7% increase on the figure reported in the previous year. In turn, sales stood at EUR 3,613.7 million on 31 December 2022, 15.7% higher than in the same period in 2021. Both the domestic market (accounting for 41% of the total) and the international market (59%) have recorded a noticeable improvement of 4.8% and 24.9% respectively.

This promising trend in all the Group’s figures has been made possible by the execution of major projects as part of Elecnor’s sustainable business particularly in Australia, Brazil, Chile, the Dominican Republic, Mozambique, Cameroon and Angola, as well as the increased volume of activities related to Essential Services which the Group provides and which take place in the United States and in Europe, mainly in Spain and Italy. In turn, Enerfín, the Elecnor Group’s renewable energy subsidiary, has benefited from the level of prices in Spain, as well as the revaluation of the Brazilian real and the Canadian dollar.

EBITDA stands at EUR 302 million, an 11.1% increase on the previous year’s figure. The Group’s results reflect the positive evolution of the Services and Projects Business, as well as that of Investment in Infrastructures and Renewable Energy, both of them activities which the Group is based on and which mutually complement and reinforce each other.

Elecnor (Essential Services and Sustainable Projects)

In a breakdown by area of Business, the turnover of Elecnor (Essential Services and Sustainable Projects) has risen by 15.7%, to EUR 3,422.9 million, while its attributable net profit has reached EUR 77.5 million (+0.4%).

In the domestic market, activity has continued its upwards trend due to the essential services provided in the energy, telecommunications, water, gas and transport sectors. It has also been supported by promotion and construction works for wind and solar power farms and refurbishment and maintenance projects related to self-consumption and energy efficiency.

In the international market, the positive tendency is mainly due to the projects that the Group is working on in Australia, and the construction of electricity transmission lines in Brazil and Chile, as well as to the US subsidiaries (Hawkeye and Belco). There has also been a positive influence coming from the construction of wind farms in Colombia, solar power plants in the Dominican Republic, Colombia and Ghana, hydroelectric power stations in Cameroon and Angola, and substations in DR Congo. Several of these projects are still in the initial stages for which the Group has made a cautious estimate of the margin, which generates an increase in the revenue figure which has not yet been passed on to the bottom line to the same extent.

The production portfolio of projects due to be executed in the next 12 months amounts to EUR 2,408 million (EUR 2,291 million at the end of 2021). The international market accounts for 74% of this portfolio figure, with a total of EUR 1,774 million and 26% comes from the domestic market, with a total of EUR 633 million. The domestic market portfolio is mainly made up of contracts for activities in essential services. The international portfolio has increased both in European countries (Italy and the United Kingdom), where activities relating the to essential services are conducted, and in other countries (mainly Australia, the United States, Brazil, Mexico and Panama) where contracts have been awarded for major sustainable projects involving the construction of renewable energy power plants and power transmission.

Investment in Infrastructures and Renewable Energy

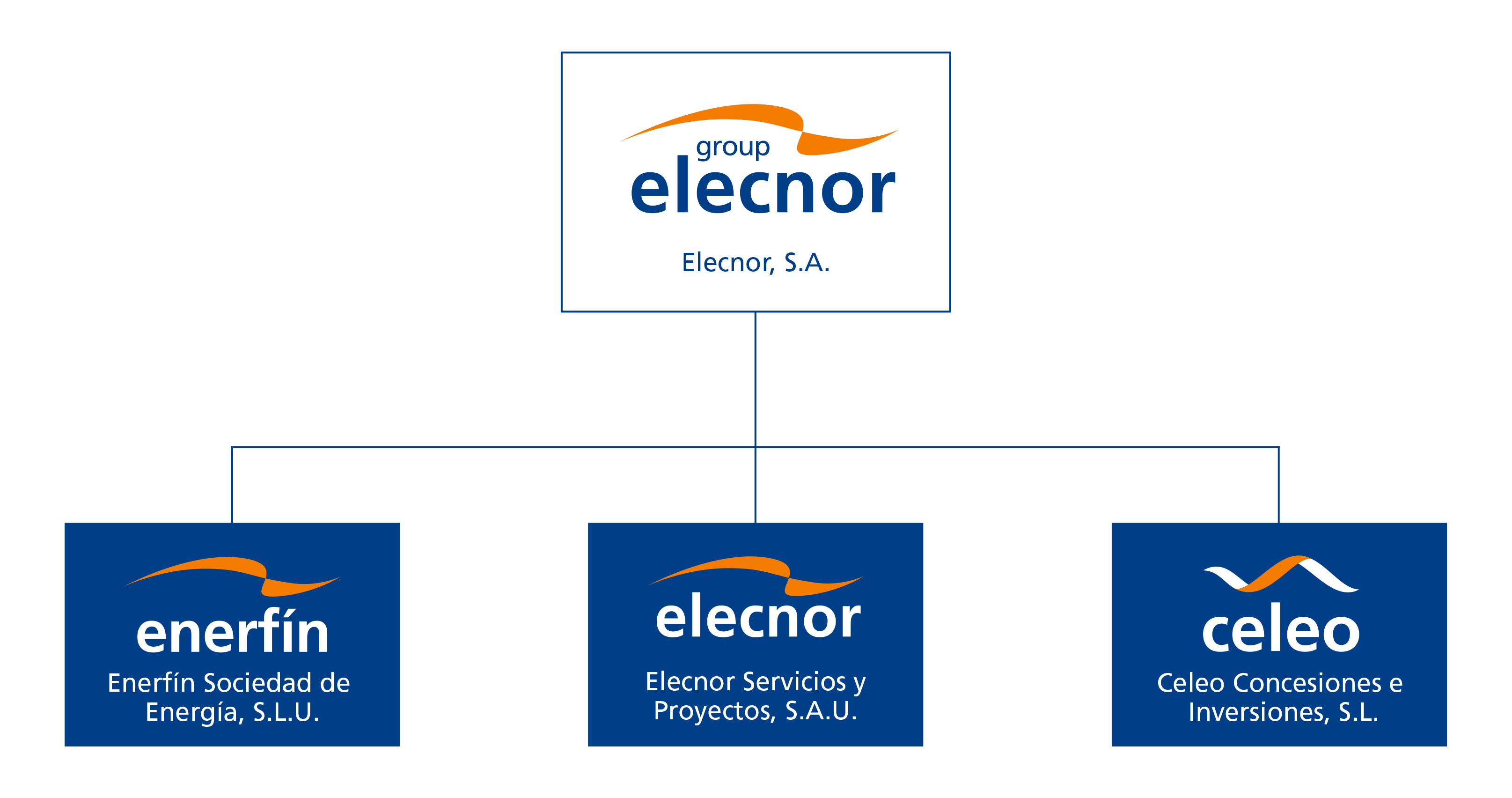

In investment projects, which the Elecnor Group operates through its subsidiary Enerfín, its partially-owned subsidiary Celeo, and their dependent companies, 2022 ended with record highs in its main business figures.

Enerfín has stakes in 1,552 MW of renewable energy both in use and under construction in Spain, Brazil, Canada and Colombia and will continue with its intense promotional activity to ensure its growth and to increase its pipeline, which currently represents almost 9 GW in wind and photovoltaic energy projects. Furthermore, it will continue to encourage the diversification of its activity with projects in storage, hybridisation and green hydrogen.

Enerfín’s Turnover has grown by 32.3% in relation to the previous year, reaching EUR 220.4 million, while its attributable net profit has soared by 89.1% to 44.1 million.

Celeo, a company jointly owned and managed with APG, has stakes in 6.812 km of electricity power transmission lines in Chile and Brazil, both in use and under construction, as well as 345 MW of renewable energy (photovoltaic and thermosolar) in Spain and Brazil. In this period, it is also worth mentioning the start of work on the first concession in Peru (Puerto Maldonado). The combination of assets in operation that the company manages comes to about EUR 5.924 million at year end.

Celeo is consolidated in the Group accounts by means of the Equity Method, so consequently no sales figures are included. In 2022, this subsidiary has posted a consolidated attributable net profit of EUR 17.2 million (compared to 15 million twelve months earlier). This profit, due to the consolidation method used, matches the pre-tax profit and the EBITDA that this business contributes to the Group.

A strong balance sheet and falling corporate financial debt

During the course of 2022, the Elecnor Group has managed to generate a cash flow of EUR 226.9 million (vs. 206.2 million in 2021) from its operating activities and has made a net investment to the value of EUR 128.5 million (100 million in 2021).

Net Corporate Recourse Debt (EUR 120.8 million) has stayed on course in relation to the end of the previous year (EUR 119.4 million). This is mainly due to the positive evolution of the Group’s business in terms of cash generation from its operating activities.

The debt ratio at the end of this year, calculated as Net Recourse Debt divided by recourse EBITDA, stands at 0.63 times (a notable reduction from the 0.72 times recorded at the end of the previous year due to the positive evolution of business in terms of cash generation).

Dividend

The Board of Directors has approved the presentation of a proposal to the General Meeting of Shareholders to pay a final dividend of EUR 0.36053065 per share that, combined with the dividend issued against the 2022 earnings which was paid out to shareholders last December (EUR 0.06259868 per share), comes to a total dividend of EUR 0.42312933 per share. This means an increase of 19.71% compared to the dividend against the 2021 financial year and a Pay-out of 36% against the Group’s 2022 earnings, which is in line with the shareholder care policy and significantly improving shareholder remuneration.

A sound financial strategy linked to sustainability

In line with its firm commitment to a sound, sustainable strategy, the Elecnor Group follows a strategy of diversification and cost optimisation regarding its sources of financing, where the following are at the forefront:

- A Syndicated Loan Agreement (formalised in 2014, the most recent novation being in 2021) with a limit of EUR 350 million, divided between a Loan Tranche of 50 million and a Credit Tranche of 300 million, with a September 2026 maturity date. This financing meets the requirements established by the “Sustainability Linked Loan Principles”, and therefore has been classified as sustainable.

- A new multi-currency Promissory Note Programme (euros and dollars) has been launched on the MARF (Spanish Alternative Fixed-Income Market) (published in June 2022) with a limit of EUR 400 million and terms of up to 24 months, to fund working capital needs and new projects, both in Spain and overseas. This is the first Elecnor Group Programme linked to sustainability, including objectives for the reduction of greenhouse gas emissions and accidents in the workplace.

- Since 2021, the Elecnor Group has signed three long-term private placements for a total of EUR 100 million.

- EUR 50 million over a period of 10 years, in the form of a sustainable loan, managed by Banca March.

- EUR 20 million over a period of 10 years, which additionally complies with the “Green Loan Principles” by assigning funds to projects classified as green, managed by Banco Sabadell.

- EUR 30 million over a period of 14 years, in the form of sustainability bonds, also managed by Banco Sabadell, included on the MARF. They hold a BBB- rating for the Elecnor Group (Investment Grade), issued by Axesor.

- Since December 2020, the Group has had a Securitisation Fund in place called “ELECNOR EFICIENCIA ENERGÉTICA 2020, Fondo de Titulización” (ELECNOR ENERGY EFFICIENCY 2020, Securitisation Fund), to which it has assigned the credit claims arising from the contracts for energy service management and maintenance of public lighting systems, which are being carried out for 43 municipalities and public authorities in Spain. Through this structure, Elecnor obtained the financing for investment in the agreements assigned, for the amount of EUR 50 million.

Committed to the environment

- 2035 Climate Change Strategy aligned with the recommendations of the TCFD

- Validation of emission reduction targets by SBTi for 2035 (reduction of scope 1 and 2 by 38% and scope 3 by 18%)

- Leadership score in the CDP ranking attesting to the Elecnor Group’s position in terms of adaptation and mitigation in the face of climate change

- Analysis of climate risks and opportunities

- Environment certificate for carbon dioxide emissions obtained from the Spanish Association for Standardisation and Certification (AENOR) and verified in accordance with ISO 14064-1:2018 standard

- Driving renewable energies with projects aimed at the hybridisation of wind power with photovoltaic energy and storage, as well as the generation, storage and supply of green hydrogen

- 1,897 MW of renewable energy facilities in operation and under construction, 12% more than the previous year

- Management of biodiversity and protection of the natural environment in all projects

Focused on people

- Achieved the best accident rates ever recorded by the company

- Health and safety at the heart of the business

- Joined the CEO Alliance for Diversity, aimed at researching, developing and driving strategies and best corporate practices for diversity, equity, and inclusion

- Operational excellence: increased customer satisfaction

- 4% Growth in workforce, 12% more women and 31% women in structure

- Through the Elecnor Foundation, we invest in and develop infrastructures for the progress of society

Responsible management

- Compliance system aligned with the highest international standards

- New Local Community Relations Policy

- New regime of directors' remunerations for 2022-2025

- Restructuring of the Board of Directors: reduction in the number of directors and appointment of a new female independent director

- Supply chain aligned with the Group’s sustainability standards

- Certification of Social Responsibility Management System based on the IQNet SR10 standard

- UNE-ISO 37001 Anti-bribery management systems standard

- UNE 19601 Criminal compliance management systems standard